Recruiter Index: All You Need to Know About the September 2022 Hiring Trends

In the latest jobs report from the United States labor department for September, the unemployment rate fell to 3.5%. The average hourly wage rose 5% compared to the same time last year. Nonfarm payrolls increased to 263,000 for the month. All of these signs point to a strong job market, despite threats of a recession coupled with high interest rates and inflation.

Recruiters are the people who are working on the front lines of the job market, and they have some of the best insights. Each month, Recruiter.com reaches out and surveys these recruiters so that we can provide you with the best insights.

Keep reading to learn what these recruiters noticed for September.

What Is the Recruiter Index?

Recruiter.com has been working on the Recruiter Index since April 2020, and this survey has predicted the Bureau of Labor Statistics labor force report before it even comes out. We do this by surveying talent acquisition professionals and recruiters. These professionals work closely with the job market and have their fingers on the pulse.

For September, we asked 326 United States recruiters or talent acquisition professionals to take our survey. If you’re interested in participating in the October survey, which will come out in November, follow this link.

Recruiting Trends

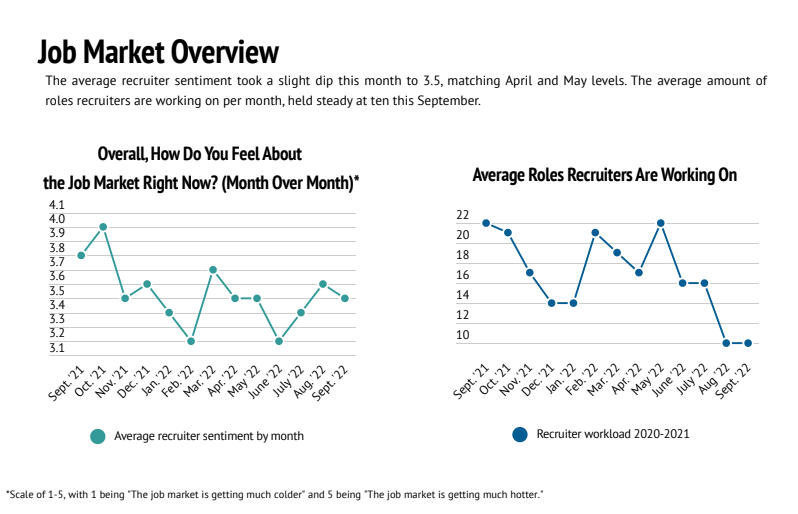

For September 2022, Recruiter.com found that the recruiter sentiment score was 3.5/5. This indicates how recruiters are feeling about the current job market. We ask recruiters to rank the job market on a scale of one to five. One represents a colder job market, but five means that the job market is getting hotter, so with a 3.5, the job market is still relatively warm. It has only decreased by .1 point since August 2022.

The survey found that recruiters are working on an average of ten job openings. This has been holding steady since August 2022. Around 54% of recruiters said that they saw the number of applicants applying for a job increase as fewer jobs exist, but more candidates are still quitting. Even with a looming recession, the quit rate was still high, so more candidates were applying for fewer jobs.

“It’s still a candidate’s world. Candidates certainly think it’s still their world in terms of their ability to decide what roles they want,” said Evan Sohn, CEO of Recruiter.com. “Job mobility is not going away anytime soon.”

One of the reasons that job mobility will remain elevated is that candidates are still searching for jobs, but it’s now easier to apply and interview for new opportunities. In addition, many companies are still laying off employees, which can make other employees anxious. When this happens, they might start actively searching for a new job.

Another sign that hiring has slowed down is that, for the first time, no recruiter said that all of the roles they were recruiting for were brand new. Recruiters said that 30% of the roles they are working on are brand new, and the other 70% are existing jobs that they still haven’t found the right hire. Recruiters are focusing more on backfilling roles that they weren’t able to while they were rapidly hiring.

One of the reasons that hiring might have slowed down over the past nine months is that many companies are taking a pause and trying to determine if they want to keep hiring. Many companies are watching the market closely to see what will happen in a recession. However, the open job numbers are still very high, and the job market is still strong.

While on CNBC, Sohn commented on the current job market: “It’s the Great Hesitation. We have a hiring freeze; companies don’t want to hire and they don’t want to fire. They spent all this money on hiring, and are wondering if they really want to lay people off or wait three months from now and see when things start to turn. There’s a hesitation.”

Candidate Trends

In addition to the recruiter sentiment, we also track the candidate sentiment. On a scale of one to five, one represents candidates not being open to new jobs. At five, candidates are more open to new opportunities. For September, the candidate sentiment score is 3.6/5, which is still high during the threat of a recession. While the sentiment did decrease slightly since August, it’s still above the candidate sentiment ranking for September 2021.

The number of candidates who have held two jobs in the past two years also increased by 15% to sit at 54%. The number of candidates who have had three jobs in the past two years is 32%, which means that the Job Hopper market is still very active.

One reason the Job Hopper economy is here to say is the shift back into in-person roles. Our survey found that 18% of candidates say remote work is the most crucial factor when considering a new job. But while many candidates would still prefer remote positions, the recruiters we surveyed found that they had a 15% increase in hiring for in-person roles. Of all the roles they’re filling, 34% are remote, 38% of in-person roles, and hybrid roles are 28%.

Another interesting thing that recruiters noticed is that most jobs still require a college degree. They said that 78% of the jobs they’re recruiting for require a college degree. However, 22% of jobs don’t need one, which opens the door for even more candidates. Companies could expand their talent pool if they decide to look at candidates without a college degree and just focus on on-the-job training.

In September, we also discovered that a lot of candidates’ priorities are changing as well. For example, compensation is only the most critical factor for 15% of candidates. Twenty-five percent of candidates listed having a work-life balance as the most important factor; 14% said the job title was important, 19% said they were looking for new experiences, and 5% said PTO was most important.

Work-life balance is now the number one spot above compensation, even with record inflation. However, while compensation isn’t the number one priority for candidates looking for new jobs, it is the main reason employees leave their jobs.

Forty-six percent of candidates said compensation was the only reason they left their current job. After that, 38% of candidates said they left because of bad management. Benefits were the reason for 8% of candidates. Three percent said they wanted remote work, and the other 5% left for various other reasons. Companies should still be focusing on providing fair salaries, but they should also look at their management. If you address these two major concerns, you could increase your employee retention rate, which can help your bottom line.

Even though candidates may not list compensation as the number one priority anymore, salaries are still increasing to try and keep up with inflation. 54% of recruiters said wages increased slightly higher (8%) than in August 2022. 36% said that most recruiters saw increases for those who made between $40 and $80,000.

Industry Hiring Trends

While inflation and a recession are genuine concerns for the job market, some industries are more active than others.

In September, architecture and engineering were the most active industries regarding job growth and hiring. Forty-five percent of recruiters said that architecture and engineering were the most dynamic industries, and 35% of recruiters said that apparel and fashion were the most active. The third most active industry was auditing and accounting, with 22% of recruiters saying they were recruiting in that industry.

Some industries that have slowed down are education, recruiting and staffing, and IT and software engineering. Here is the complete list of the most active industries that our surveyed recruiters are hiring in:

- Architecture/Engineering: 45% (+10% from August)

- Apparel Fashion: 35% (+26% from August)

- Accounting/Auditing: 22% (+14% from August)

- Automotive: 18% (-6% from August)

- Education: 8% (+/- 0 from August)

- Recruiting/Staffing: 6% (-4% from August)

- Sales: 5% (-2% from August)

- IT/Software Engineering: 4% (-21% from August)

- Hospitality: 3% (-2% from August)

- Medical/Health care: 3% (-6% from August)

If you want to see more insights about this month’s Recruiter Index, you can watch a live presentation with Sohn.

Start Hiring Today

Overall, the job market is still very strong, and while it’s slowing down, it could quickly pick back up in a few months.

Companies should take the time to evaluate their current hiring needs and figure out how they can prepare for the future. They need to have a plan for if they need to have a hiring freeze or a rapid hiring period.

If you need to hire and have had problems backfilling difficult roles, that’s where our recruiters can help you out. We have different recruiting solutions that can fill that difficult position, so contact us today to learn more about how we can help your company!

Get the top recruiting news and insights delivered to your inbox every week. Sign up for the Recruiter Today newsletter.